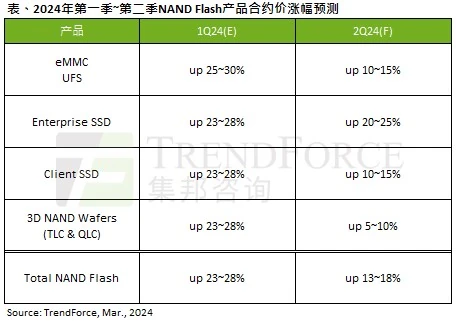

NAND flash memory contract prices are expected to rise by 13 to 18%, driving consumer SSD prices to increase by more than 10% - TrendForce report

According to TrendForce's analysis, although the purchase volume of NAND flash memory in the second quarter was slightly lower than that in the first quarter, the overall market sentiment was still affected due to the impact of upstream production cuts. In addition, supplier inventory levels are also declining, so flash memory contract prices are expected to continue to rise.

In terms of specific categories, demand for eMMC is likely to increase as some suppliers have reduced the supply of such products. Chinese smartphone brands have also begun to increase the use of domestic module factory solutions. The eMMC contract price is expected to increase by 10-15% quarter-to-quarter in the second quarter.

Regarding UFS, demand for smartphones in India and Southeast Asia has grown significantly, and domestic mobile phone companies are also increasing inventory levels in advance, thus providing demand for UFS flash memory. At the same time, as suppliers pursue the goal of quickly achieving profit and loss balance, UFS contract prices will also rise by 10 to 15%.

In terms of enterprise-level/data center-level solid-state drives, demand from cloud service providers in China and North America has increased. In addition, buyers plan to increase inventory levels before the peak season in the second half of the year. The contract price of this type of product is expected to increase by 20-25% quarter-on-quarter, the highest increase. .

As for consumer-grade solid-state drives, it is currently in the off-season for terminal sales, and downstream PC brand manufacturers are unable to transfer the impact of price increases by adjusting finished product prices. Therefore, order demand this year has been suppressed, and the overall product contract price is expected to increase by 10 to 15% in the second quarter. .

In terms of NAND flash memory wafers, although the original manufacturers hope to achieve profitability as soon as possible, the overall retail market demand is sluggish, so the growth rate will be significantly reduced compared with the previous quarter, and is expected to be only 5 to 10%.